CATEGORY > CS Metrics

Gross Retention vs. Net Retention: Which Tells the Real Story?

Introduction

Net Revenue Retention and Gross Revenue Retention are two key metrics used in the context of subscription-based businesses, especially Software as a Service (SaaS) companies, to assess the overall health and growth of their customer base and revenue streams.

They provide insights into how effectively a company is retaining and expanding its revenue from existing customers. Let’s jump right in to understand what each metric signifies and how you need to align your practice in order for these to work for you.

What is Gross Revenue Retention (GRR)?

Gross Revenue Retention measures the percentage of revenue retained from existing customers over a specific period, usually a year.

It takes into account the total revenue generated from existing customers at the beginning of the period and then evaluates the same against the revenue generated from those same customers at the end of the period along with any upsells, cross-sells, or renewals. It doesn't consider revenue lost due to customer churn.

Gross Revenue Retention provides insight into the ability of a business to expand its revenue from its existing customer base.

How to calculate Gross Revenue Retention?

Formula for Gross Revenue Retention:

Gross Revenue Retention = [(Ending Revenue from Existing Customers / Starting Revenue from Existing Customers)] * 100

*Here, 'Ending Revenue from Existing Customers' does not include expansion or upsell revenue

What is Net Revenue Retention (NRR)?

Net Revenue Retention measures the overall revenue growth from existing customers, accounting for both expansion and churn (customer attrition). It takes into consideration not only the revenue retained from customers who remain active but also the additional revenue generated from upsells, cross-sells, and expansions within the existing customer base.

A positive NRR indicates that the company is achieving net revenue growth from its existing customers, even after accounting for any losses due to churn.

How to calculate Net Revenue Retention?

NRR is expressed as a percentage and can be calculated using the formula:

NRR = [(Ending Monthly Recurring Revenue - Churn) / Starting Monthly Recurring Revenue] × 100

Gross Retention vs. Net Retention – What’s the difference?

Let’s consider, that you have a subscription-based business with an initial Monthly Recurring Revenue (MRR) of $10,000. Over a period, you experience churn (customers leaving) worth $1,000, but you also generate expansion revenue (upsells and cross-sells) worth $500 from your existing customers.

Gross Revenue Retention = ($10,000 - $1,000) / $10,000 * 100 = 90%

Net Revenue Retention = ($10,000 - $1,000 + $500) / $10,000 * 100 = 95%

How to Maximize Net Revenue Retention?

Maximizing net revenue retention (NRR) is a critical goal for any subscription-based business and involves strategies to retain and expand existing customers to drive sustainable revenue growth. NRR measures the net change in revenue from existing customers over a specific period, accounting for upsells, cross-sells, and churn.

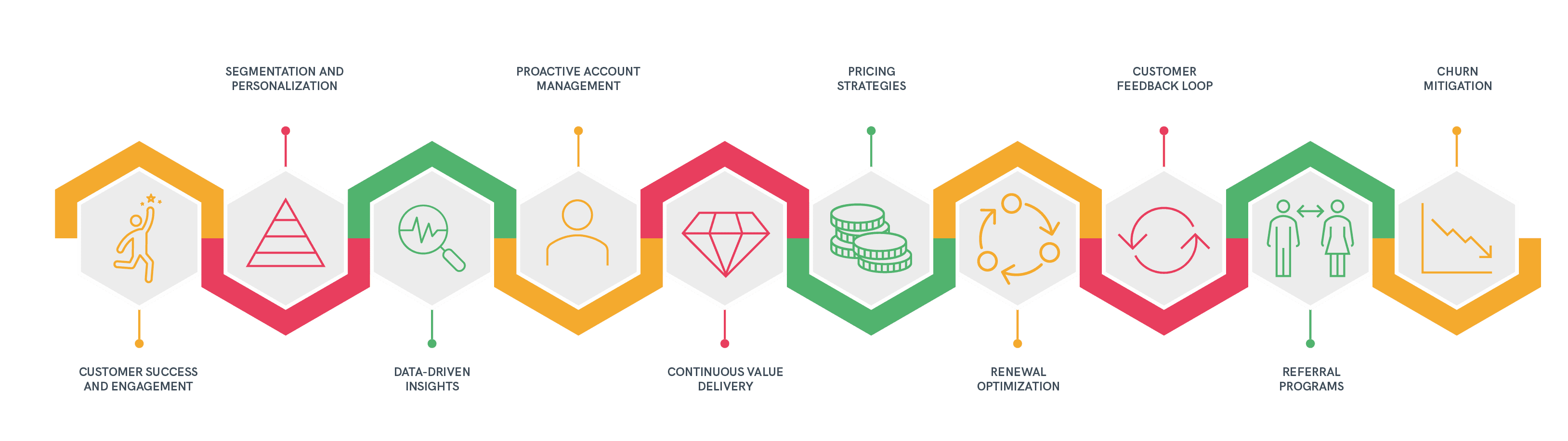

1. Customer Success and Engagement

Prioritize customer success by ensuring that your product or service effectively addresses customers' needs and delivers ongoing value. Regularly engage with customers through personalized communication and engagement, training, and support to enhance their experience.

2. Segmentation and Personalization

Segment your customers based on usage patterns, behaviour, and preferences. Tailor your communication and offerings to each segment's unique needs, increasing the likelihood of upsells and cross-sells.

3. Data-Driven Insights

Leverage data analytics to gain insights into customer behaviour and usage patterns. Identify upsell and cross-sell opportunities by understanding which features or services are most valuable to different customer segments.

4. Proactive Account Management

Assign dedicated account managers or customer success teams to high-value customers. These teams can provide personalized guidance, identify expansion opportunities, and mitigate potential issues before they escalate.

5. Continuous Value Delivery

Regularly enhance your product or service with new features, improvements, and updates that address evolving customer needs. This not only boosts customer satisfaction but also creates opportunities for upsells.

6. Pricing Strategy

Implement dynamic pricing models that offer tiered plans with increasing value and benefits. Gradually introduce price increases as customers derive more value from your offerings, capturing additional revenue.

7. Renewal Optimization

Streamline the renewal process with automated reminders and seamless contract management. Offer incentives for longer-term commitments, reducing churn risk.

8. Customer Feedback Loop

Establish a feedback mechanism to capture customer input, suggestions, and pain points. Act on this feedback to improve your product and maintain a customer-centric approach.

9. Referral Programs

Encourage satisfied customers to refer new business through referral programs. Reward both the referring customer and the new customer, driving customer acquisition and revenue expansion.

10. Churn Mitigation

Develop proactive churn mitigation strategies by identifying at-risk customers and taking targeted actions to retain them. Offer tailored incentives, exclusive features, or personalized support to win back their loyalty.

By adopting a holistic approach that focuses on customer success, data-driven insights, and personalized strategies, businesses can maximize net revenue retention. Regularly analyze and refine your approach based on key performance indicators (KPIs) to ensure consistent growth and sustainable revenue streams from existing customers.

How to Maximize Gross Revenue Retention?

Maximizing gross revenue retention involves strategies aimed at retaining as much revenue from existing customers as possible. This is crucial for sustainable business growth. To achieve this:

1. Provide Exceptional Value

Continuously deliver products or services that solve customer problems or fulfil needs exceptionally well. Consistently exceed customer expectations, building strong loyalty and reducing the likelihood of churn.

2. Regular Communication

Maintain open and transparent communication with customers. Keep them informed about updates, enhancements, and how your offerings can address their evolving needs.

3. Renewal Incentives

Offer incentives for contract renewals, such as discounts or additional features. Showcase the value they will continue to receive by staying with your product or service.

4. Customer Community

Create a community platform where customers can connect, share experiences, and offer advice. This sense of belonging can foster long-term engagement.

5. Long-Term Contracts

Encourage longer contract commitments by offering discounts or other benefits. This provides stability for both the customer and your revenue stream.

6. Regular Check-Ins

Maintain consistent touchpoints with your customers. Regularly assess their satisfaction levels and identify potential areas for improvement.

By combining these strategies, you can enhance the overall customer experience, cultivate lasting relationships, and optimize gross revenue retention. Remember, fostering loyalty often yields greater returns than solely focusing on new customer acquisition.

Conclusion: Which Metric to Track for Your Business?

For most businesses, tracking Net Revenue Retention (NRR) is recommended. NRR provides a more comprehensive view of your revenue growth from existing customers. It considers both the revenue retained from customers who remain and the additional revenue generated from expansions within your customer base.

NRR takes into account the upsell and cross-sell potential, giving you a better understanding of how effectively you are leveraging your existing customer relationships to drive growth. It provides insights into your ability to not only retain customers but also to increase their spending over time.

While Gross Revenue Retention provides a more conservative view focused solely on retention, NRR offers a more accurate picture of the overall health and growth potential of your customer base. Monitoring NRR can help you make informed decisions about customer engagement strategies, pricing adjustments, and overall business expansion.

FAQs

1. What is the difference between NRR and GRR?

Net revenue retention measures the percentage of revenue retained from existing customers after accounting for upsells, cross-sells, and expansion, minus any losses from churn or downgrades. It provides insights into how well your company is growing existing customer revenue. On the other hand, gross revenue retention measures the percentage of revenue retained from existing customers without considering any upsells or expansions, only accounting for churn and downgrades. It reflects customer satisfaction and retention without the impact of growth efforts.

2. Why is NRR important for understanding company growth?

NRR is crucial because it includes the effect of upsells, cross-sells, and expansions, giving a more comprehensive picture of revenue growth from existing customers. A high NRR indicates that your company is retaining customers and successfully increasing revenue from them, which is a positive sign of overall business health and growth.

3. How can a company improve its gross revenue retention?

To improve GRR, focus on reducing churn and minimizing downgrades by enhancing customer satisfaction, providing excellent customer support, and delivering consistent value. Implementing strategies like regular check-ins, proactive problem-solving, and addressing customer feedback can help retain customers and maintain revenue stability.

ABOUT THE AUTHOR

Popular from CS Metrics

Quality Content,

Straight To Your Inbox!

Subscribe for the latest blogs, podcasts, webinars, and events!

Write a Blog

If you have experience in CS and

a flair for writing, we’d love to

feature you.

Write to us on

hello@zapscale.com